Featured schools near , edit

Types of Degrees Majors Are Getting

The following table lists how many finance graduations there were for each degree level during the last year for which data was available.

| Education Level | Number of Grads |

|---|---|

| Bachelor’s Degree | 46,405 |

| Master’s Degree | 4,292 |

| Graduate Certificate | 482 |

| Basic Certificate | 261 |

| Associate Degree | 134 |

| Undergraduate Certificate | 56 |

| Doctor’s Degree | 28 |

What Majors Need to Know

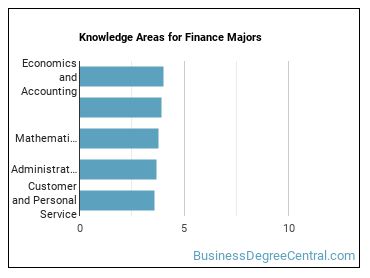

O*NET surveyed people in occupations related to finance and asked them what knowledge areas, skills, and abilities were important for their jobs. The responses were rated on a scale of 1 to 5 with 5 being most important.

Knowledge Areas for Finance Majors

Finance majors often go into careers in which the following knowledge areas are important:

- Economics and Accounting - Knowledge of economic and accounting principles and practices, the financial markets, banking and the analysis and reporting of financial data.

- English Language - Knowledge of the structure and content of the English language including the meaning and spelling of words, rules of composition, and grammar.

- Mathematics - Knowledge of arithmetic, algebra, geometry, calculus, statistics, and their applications.

- Administration and Management - Knowledge of business and management principles involved in strategic planning, resource allocation, human resources modeling, leadership technique, production methods, and coordination of people and resources.

- Customer and Personal Service - Knowledge of principles and processes for providing customer and personal services. This includes customer needs assessment, meeting quality standards for services, and evaluation of customer satisfaction.

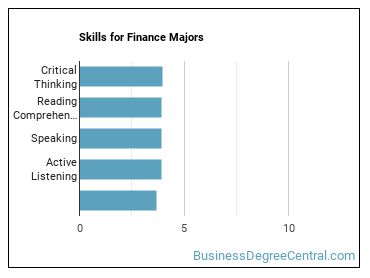

Skills for Finance Majors

When studying finance, you’ll learn many skills that will help you be successful in a wide range of jobs - even those that do not require a degree in the field. The following is a list of some of the most common skills needed for careers associated with this major:

- Critical Thinking - Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

- Reading Comprehension - Understanding written sentences and paragraphs in work related documents.

- Speaking - Talking to others to convey information effectively.

- Active Listening - Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

- Judgment and Decision Making - Considering the relative costs and benefits of potential actions to choose the most appropriate one.

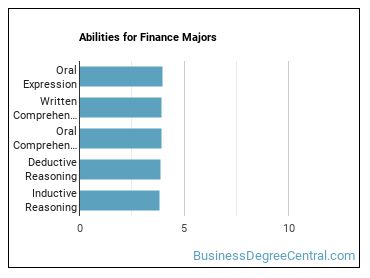

Abilities for Finance Majors

Some of the most crucial abilities to master while a finance student include the following:

- Oral Expression - The ability to communicate information and ideas in speaking so others will understand.

- Written Comprehension - The ability to read and understand information and ideas presented in writing.

- Oral Comprehension - The ability to listen to and understand information and ideas presented through spoken words and sentences.

- Deductive Reasoning - The ability to apply general rules to specific problems to produce answers that make sense.

- Inductive Reasoning - The ability to combine pieces of information to form general rules or conclusions (includes finding a relationship among seemingly unrelated events).

What Can You Do With a Major?

People with a finance degree often go into the following careers:

| Job Title | Job Growth Rate | Median Salary |

|---|---|---|

| Budget Analysts | 6.5% | $76,220 |

| Credit Analysts | 8.3% | $71,520 |

| Financial Analysts | 10.8% | $85,660 |

| Financial Managers, Branch or Department | 18.7% | $127,990 |

| Financial Quantitative Analysts | 9.6% | $70,280 |

| Fraud Examiners, Investigators and Analysts | 9.6% | $70,280 |

| General and Operations Managers | 9.1% | $100,930 |

| Investment Underwriters | 9.6% | $70,280 |

| Loan Officers | 11.4% | $63,040 |

| Personal Financial Advisors | 14.9% | $88,890 |

| Risk Management Specialists | 9.6% | $70,280 |

| Treasurers and Controllers | 18.7% | $127,990 |

Who Is Getting a Bachelor’s Degree in ?

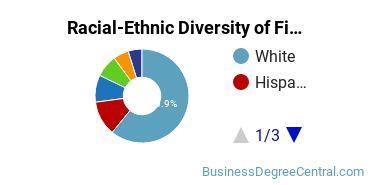

Racial-Ethnic Diversity

At the countrywide level, the racial-ethnic distribution of finance majors is as follows:

| Race/Ethnicity | Number of Grads |

|---|---|

| Asian | 3,833 |

| Black or African American | 2,165 |

| Hispanic or Latino | 5,760 |

| White | 28,259 |

| International Students | 3,707 |

| Other Races/Ethnicities | 2,681 |

Geographic Diversity

Americans aren’t the only ones with an interest in Finance. About 8.0% of those with this major are international students.

How Much Do Majors Make?

Salaries According to BLS

Average salaries range from $79,830 to $123,880 (25th to 75th percentile) for careers related to finance. This range includes all degree levels, so the salary for a person with just a bachelor’s degree may be a little less and the one for a person with an advanced degree may be a little more.

To put that into context, according to BLS data from the first quarter of 2020, the typical high school graduate makes between $30,000 and $57,900 a year (25th through 75th percentile). The average person with a bachelor’s degree (any field) makes between $45,600 and $99,000. Advanced degree holders make the most with salaries between $55,600 and $125,400.

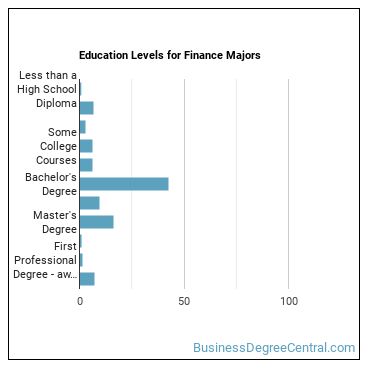

Amount of Education Required for Careers Related to

Some careers associated with finance require an advanced degree while some may not even require a bachelor’s. Whatever the case may be, pursuing more education usually means that more career options will be available to you.

Find out what the typical degree level is for finance careers below.

| Education Level | Percentage of Workers |

|---|---|

| Less than a High School Diploma | 0.6% |

| High School Diploma - or the equivalent (for example, GED) | 6.7% |

| Post-Secondary Certificate - awarded for training completed after high school (for example, in agriculture or natural resources, computer services, personal or culinary services, engineering technologies, healthcare, construction trades, mechanic and repair technologies, or precision production) | 2.8% |

| Some College Courses | 6.3% |

| Associate’s Degree (or other 2-year degree) | 6.0% |

| Bachelor’s Degree | 42.8% |

| Post-Baccalaureate Certificate - awarded for completion of an organized program of study; designed for people who have completed a Baccalaureate degree but do not meet the requirements of academic degrees carrying the title of Master. | 9.6% |

| Master’s Degree | 16.3% |

| Post-Master’s Certificate - awarded for completion of an organized program of study; designed for people who have completed a Master’s degree but do not meet the requirements of academic degrees at the doctoral level. | 0.7% |

| First Professional Degree - awarded for completion of a program that: requires at least 2 years of college work before entrance into the program, includes a total of at least 6 academic years of work to complete, and provides all remaining academic requirements to begin practice in a profession. | 1.3% |

| Doctoral Degree | 7.1% |

Online Programs

The following table lists the number of programs by degree level, along with how many schools offered online courses in the field.

| Degree Level | Colleges Offering Programs | Colleges Offering Online Classes |

|---|---|---|

| Certificate (Less Than 1 Year) | 0 | 0 |

| Certificate (1-2 years) | 15 | 4 |

| Certificate (2-4 Years) | 1 | 0 |

| Associate’s Degree | 30 | 8 |

| Bachelor’s Degree | 62 | 23 |

| Post-Baccalaureate | 0 | 0 |

| Master’s Degree | 208 | 50 |

| Post-Master’s | 23 | 0 |

| Doctor’s Degree (Research) | 16 | 1 |

| Doctor’s Degree (Professional Practice) | 0 | 0 |

| Doctor’s Degree (Other) | 0 | 0 |

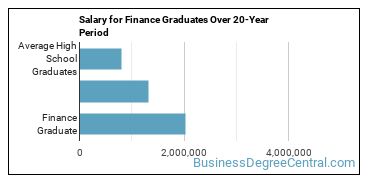

Is a Degree in Worth It?

The median salary for a finance grad is $100,990 per year. This is based on the weighted average of the most common careers associated with the major.

This is 153% more than the average salary for an individual holding a high school degree. This adds up to a gain of about $1,221,800 after 20 years!

Explore Major by State

Alabama

California

District of Columbia

Idaho

Kansas

Maryland

Mississippi

Nevada

New York

Oklahoma

South Carolina

Utah

West Virginia

Alaska

Colorado

Florida

Illinois

Kentucky

Massachusetts

Missouri

New Hampshire

North Carolina

Oregon

South Dakota

Vermont

Wisconsin

Majors Related to

You may also be interested in one of the following majors related to finance.

| Major | Number of Grads |

|---|---|

| Financial Planning & Services | 1,136 |

| Banking and Financial Support Services | 953 |

| Other Finance and Financial Management Services | 415 |

| Investments and Securities | 385 |

| International Finance | 93 |

| Public Finance | 41 |

| Credit Management | 9 |

| Financial Risk Management | 0 |

References

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

- College Factual

- College Scorecard

- National Center for Education Statistics

- O*NET Online

- U.S. Bureau of Labor Statistics

- Usual Weekly Earnings of Wage and Salary Workers First Quarter 2020

- Image Credit: By Dave Dugdale under License

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School