What is a Credit Analyst?

Job Description & Duties Analyze credit data and financial statements of individuals or firms to determine the degree of risk involved in extending credit or lending money. Prepare reports with credit information for use in decision making.

Credit Analyst Responsibilities

- Prepare reports that include the degree of risk involved in extending credit or lending money.

- Review individual or commercial customer files to identify and select delinquent accounts for collection.

- Complete loan applications, including credit analyses and summaries of loan requests, and submit to loan committees for approval.

- Compare liquidity, profitability, and credit histories of establishments being evaluated with those of similar establishments in the same industries and geographic locations.

- Analyze credit data and financial statements to determine the degree of risk involved in extending credit or lending money.

- Evaluate customer records and recommend payment plans, based on earnings, savings data, payment history, and purchase activity.

Featured schools near , edit

Credit Analyst Required Skills

These are the skills Credit Analysts say are the most useful in their careers:

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Types of Credit Analyst

- Analyst

- Loan Review Analyst

- Credit Assessment Analyst

- Credit Specialist

- Underwriter

What Kind of Credit Analyst Job Opportunities Are There?

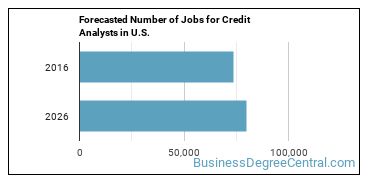

There were about 73,800 jobs for Credit Analyst in 2016 (in the United States). New jobs are being produced at a rate of 8.3% which is above the national average. The Bureau of Labor Statistics predicts 6,100 new jobs for Credit Analyst by 2026. The BLS estimates 6,800 yearly job openings in this field.

The states with the most job growth for Credit Analyst are Utah, Arizona, and Nevada. Watch out if you plan on working in Wyoming, West Virginia, or Vermont. These states have the worst job growth for this type of profession.

Do Credit Analysts Make A Lot Of Money?

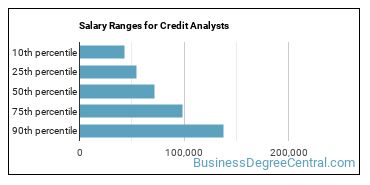

The salary for Credit Analysts ranges between about $43,100 and $137,610 a year.

Credit Analysts who work in District of Columbia, New York, or Virginia, make the highest salaries.

How much do Credit Analysts make in different U.S. states?

| State | Annual Mean Salary |

|---|---|

| Alabama | $80,900 |

| Arizona | $63,710 |

| Arkansas | $60,540 |

| California | $89,430 |

| Colorado | $76,870 |

| Connecticut | $93,970 |

| Delaware | $68,010 |

| District of Columbia | $108,420 |

| Florida | $81,410 |

| Georgia | $70,040 |

| Hawaii | $82,580 |

| Idaho | $63,950 |

| Illinois | $77,800 |

| Indiana | $61,790 |

| Iowa | $68,680 |

| Kansas | $68,720 |

| Kentucky | $75,160 |

| Louisiana | $63,690 |

| Maine | $69,420 |

| Maryland | $70,150 |

| Massachusetts | $84,020 |

| Michigan | $71,070 |

| Minnesota | $81,070 |

| Mississippi | $60,220 |

| Missouri | $75,620 |

| Montana | $71,890 |

| Nebraska | $64,420 |

| Nevada | $70,540 |

| New Hampshire | $84,250 |

| New Jersey | $85,030 |

| New Mexico | $61,500 |

| New York | $119,180 |

| North Carolina | $84,530 |

| North Dakota | $65,200 |

| Ohio | $77,510 |

| Oklahoma | $57,940 |

| Oregon | $74,520 |

| Pennsylvania | $80,710 |

| Rhode Island | $75,050 |

| South Carolina | $67,070 |

| South Dakota | $62,210 |

| Tennessee | $64,380 |

| Texas | $81,540 |

| Utah | $68,920 |

| Vermont | $77,670 |

| Virginia | $85,090 |

| Washington | $76,500 |

| West Virginia | $61,140 |

| Wisconsin | $70,550 |

| Wyoming | $57,460 |

What Tools & Technology do Credit Analysts Use?

Below is a list of the types of tools and technologies that Credit Analysts may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- SAP

- Structured query language SQL

- SAS

- Microsoft Dynamics

- Microsoft Visual Basic

- Microsoft SQL Server

- Oracle JD Edwards EnterpriseOne

- Oracle Business Intelligence Enterprise Edition

- CGI-AMS BureauLink Enterprise

- Experian Credinomics

- Moody’s KMV CreditEdge

- Fair Isaac Capstone Decision Manager

- Experian Retention Triggers

- Fair Isaac Application Risk Model Software

- Experian Quest

- Fair Isaac Falcon ID

How do I Become a Credit Analyst?

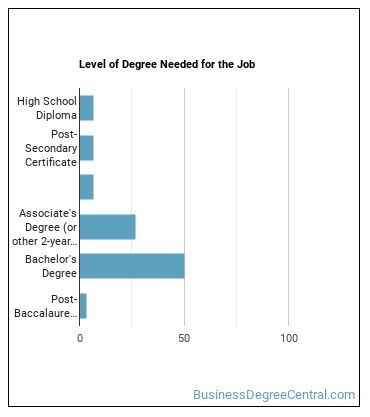

What education is needed to be a Credit Analyst?

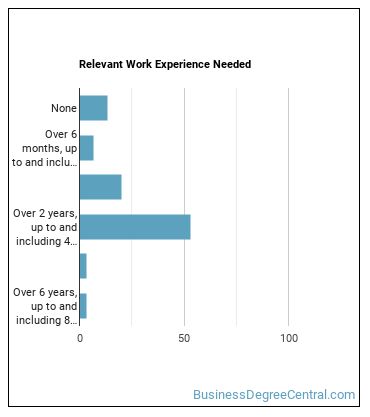

What work experience do I need to become a Credit Analyst?

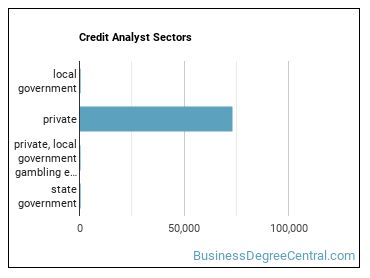

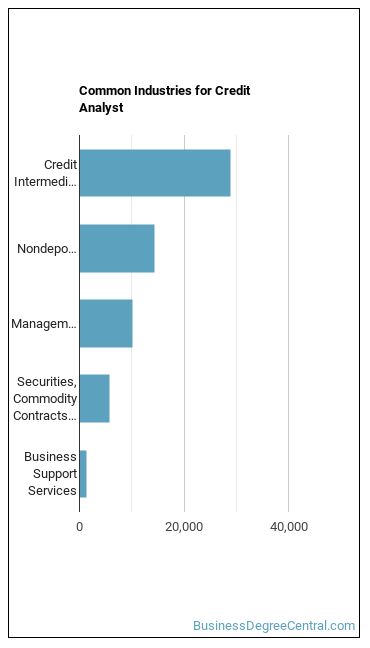

Where Credit Analysts Are Employed

The table below shows the approximate number of Credit Analysts employed by various industries.

Other Jobs You May be Interested In

Those thinking about becoming a Credit Analyst might also be interested in the following careers:

Those who work as a Credit Analyst sometimes switch careers to one of these choices:

References:

Image Credit: Pixabay via CC0 License

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School