Featured schools near , edit

Types of Degrees Majors Are Getting

The following table lists how many credit management graduations there were for each degree level during the last year for which data was available.

| Education Level | Number of Grads |

|---|---|

| Basic Certificate | 9 |

What Majors Need to Know

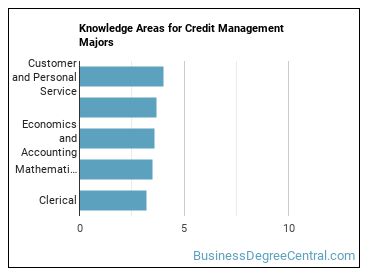

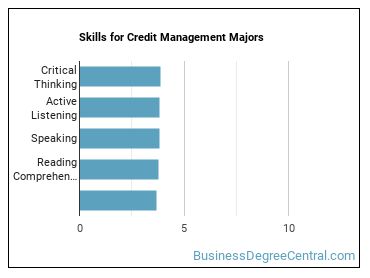

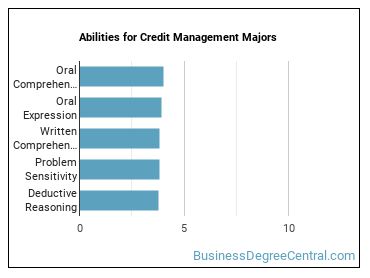

O*NET surveyed people in occupations related to credit management and asked them what knowledge areas, skills, and abilities were important for their jobs. The responses were rated on a scale of 1 to 5 with 5 being most important.

Knowledge Areas for Credit Management Majors

This major prepares you for careers in which these knowledge areas are important:

- Customer and Personal Service - Knowledge of principles and processes for providing customer and personal services. This includes customer needs assessment, meeting quality standards for services, and evaluation of customer satisfaction.

- English Language - Knowledge of the structure and content of the English language including the meaning and spelling of words, rules of composition, and grammar.

- Economics and Accounting - Knowledge of economic and accounting principles and practices, the financial markets, banking and the analysis and reporting of financial data.

- Mathematics - Knowledge of arithmetic, algebra, geometry, calculus, statistics, and their applications.

- Clerical - Knowledge of administrative and clerical procedures and systems such as word processing, managing files and records, stenography and transcription, designing forms, and other office procedures and terminology.

Skills for Credit Management Majors

The following list of skills has been highlighted as some of the most essential for careers related to credit management:

- Critical Thinking - Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

- Active Listening - Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

- Speaking - Talking to others to convey information effectively.

- Reading Comprehension - Understanding written sentences and paragraphs in work related documents.

- Judgment and Decision Making - Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Abilities for Credit Management Majors

As you progress with your credit management degree, there are several abilities you should pick up that will help you in whatever related career you choose. These abilities include:

- Oral Comprehension - The ability to listen to and understand information and ideas presented through spoken words and sentences.

- Oral Expression - The ability to communicate information and ideas in speaking so others will understand.

- Written Comprehension - The ability to read and understand information and ideas presented in writing.

- Problem Sensitivity - The ability to tell when something is wrong or is likely to go wrong. It does not involve solving the problem, only recognizing there is a problem.

- Deductive Reasoning - The ability to apply general rules to specific problems to produce answers that make sense.

What Can You Do With a Major?

People with a credit management degree often go into the following careers:

| Job Title | Job Growth Rate | Median Salary |

|---|---|---|

| Credit Analysts | 8.3% | $71,520 |

| Credit Counselors | 13.8% | $45,180 |

| Financial Managers, Branch or Department | 18.7% | $127,990 |

| Loan Officers | 11.4% | $63,040 |

How Much Do Majors Make?

Salaries According to BLS

Credit Management majors often go into careers where salaries can range from $49,820 to $82,300 (25th to 75th percentile). This range includes all degree levels, so the salary for a person with just a bachelor’s degree may be a little less and the one for a person with an advanced degree may be a little more.

To put that into context, according to BLS data from the first quarter of 2020, the typical high school graduate makes between $30,000 and $57,900 a year (25th through 75th percentile). The average person with a bachelor’s degree (any field) makes between $45,600 and $99,000. Advanced degree holders make the most with salaries between $55,600 and $125,400.

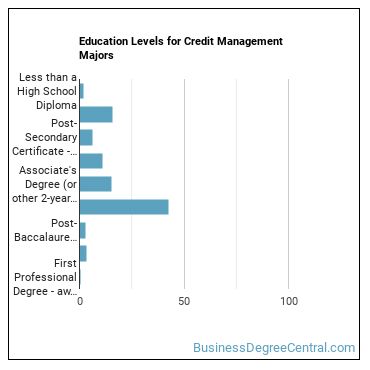

Amount of Education Required for Careers Related to

Some careers associated with credit management require an advanced degree while some may not even require a bachelor’s. Whatever the case may be, pursuing more education usually means that more career options will be available to you.

How much schooling do you really need to compete in today’s job market? People currently working in careers related to credit management have obtained the following education levels.

| Education Level | Percentage of Workers |

|---|---|

| Less than a High School Diploma | 1.9% |

| High School Diploma - or the equivalent (for example, GED) | 15.8% |

| Post-Secondary Certificate - awarded for training completed after high school (for example, in agriculture or natural resources, computer services, personal or culinary services, engineering technologies, healthcare, construction trades, mechanic and repair technologies, or precision production) | 6.4% |

| Some College Courses | 11.1% |

| Associate’s Degree (or other 2-year degree) | 15.3% |

| Bachelor’s Degree | 42.7% |

| Post-Baccalaureate Certificate - awarded for completion of an organized program of study; designed for people who have completed a Baccalaureate degree but do not meet the requirements of academic degrees carrying the title of Master. | 2.9% |

| Master’s Degree | 3.2% |

| First Professional Degree - awarded for completion of a program that: requires at least 2 years of college work before entrance into the program, includes a total of at least 6 academic years of work to complete, and provides all remaining academic requirements to begin practice in a profession. | 0.1% |

Online Programs

The following table lists the number of programs by degree level, along with how many schools offered online courses in the field.

| Degree Level | Colleges Offering Programs | Colleges Offering Online Classes |

|---|---|---|

| Certificate (Less Than 1 Year) | 0 | 0 |

| Certificate (1-2 years) | 1 | 0 |

| Certificate (2-4 Years) | 0 | 0 |

| Associate’s Degree | 0 | 0 |

| Bachelor’s Degree | 1 | 0 |

| Post-Baccalaureate | 0 | 0 |

| Master’s Degree | 0 | 0 |

| Post-Master’s | 0 | 0 |

| Doctor’s Degree (Research) | 0 | 0 |

| Doctor’s Degree (Professional Practice) | 0 | 0 |

| Doctor’s Degree (Other) | 0 | 0 |

Is a Degree in Worth It?

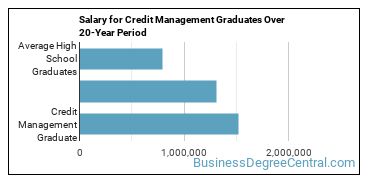

The median salary for a credit management grad is $76,270 per year. This is based on the weighted average of the most common careers associated with the major.

This is 91% more than the average salary for an individual holding a high school degree. This adds up to a gain of about $727,400 after 20 years!

Explore Major by State

Alabama

California

District of Columbia

Idaho

Kansas

Maryland

Mississippi

Nevada

New York

Oklahoma

South Carolina

Utah

West Virginia

Alaska

Colorado

Florida

Illinois

Kentucky

Massachusetts

Missouri

New Hampshire

North Carolina

Oregon

South Dakota

Vermont

Wisconsin

Majors Related to

You may also be interested in one of the following majors related to credit management.

| Major | Number of Grads |

|---|---|

| Finance | 51,658 |

| Financial Planning & Services | 1,136 |

| Banking and Financial Support Services | 953 |

| Other Finance and Financial Management Services | 415 |

| Investments and Securities | 385 |

| International Finance | 93 |

| Public Finance | 41 |

| Financial Risk Management | 0 |

References

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

- College Factual

- College Scorecard

- National Center for Education Statistics

- O*NET Online

- U.S. Bureau of Labor Statistics

- Usual Weekly Earnings of Wage and Salary Workers First Quarter 2020

- Image Credit: By Dave Dugdale under License

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School