What Does it Take to Be a Credit Counselor?

Example of Credit Counselor Job Advise and educate individuals or organizations on acquiring and managing debt. May provide guidance in determining the best type of loan and explaining loan requirements or restrictions. May help develop debt management plans, advise on credit issues, or provide budget, mortgage, and bankruptcy counseling.

Life As a Credit Counselor: What Do They Do?

- Advise clients on housing matters, such as housing rental, homeownership, mortgage delinquency, or foreclosure prevention.

- Explain general financial topics to clients, such as credit report ratings, bankruptcy laws, consumer protection laws, wage attachments, or collection actions.

- Assess clients’ overall financial situation by reviewing income, assets, debts, expenses, credit reports, or other financial information.

- Review changes to financial, family, or employment situations to determine whether changes to existing debt management plans, spending plans, or budgets are needed.

- Explain services or policies to clients, such as debt management program rules, the advantages and disadvantages of using services, or creditor concession policies.

- Teach courses or seminars on topics such as budgeting, managing personal finances, or financial literacy.

Featured schools near , edit

Qualities of a Credit Counselor

When polled, Credit Counselors say the following skills are most frequently used in their jobs:

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Service Orientation: Actively looking for ways to help people.

Types of Credit Counselor

- Debt and Budget Counselor

- Mortgage Counselor

- Loan Counselor

- Financial Wellness Coach

- Debt Management Counselor

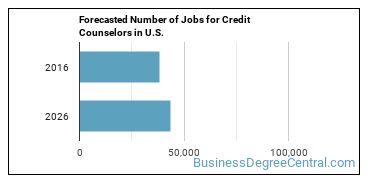

Job Demand for Credit Counselors

In 2016, there was an estimated number of 38,300 jobs in the United States for Credit Counselor. New jobs are being produced at a rate of 13.8% which is above the national average. The Bureau of Labor Statistics predicts 5,300 new jobs for Credit Counselor by 2026. The BLS estimates 3,800 yearly job openings in this field.

The states with the most job growth for Credit Counselor are Utah, North Dakota, and Idaho. Watch out if you plan on working in Wyoming, Vermont, or Maine. These states have the worst job growth for this type of profession.

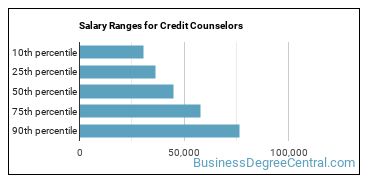

Do Credit Counselors Make A Lot Of Money?

The average yearly salary of a Credit Counselor ranges between $30,440 and $76,690.

Credit Counselors who work in District of Columbia, New Jersey, or Nevada, make the highest salaries.

Below is a list of the median annual salaries for Credit Counselors in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $48,260 |

| Arizona | $45,880 |

| Arkansas | $49,770 |

| California | $53,170 |

| Connecticut | $57,500 |

| Delaware | $52,360 |

| District of Columbia | $77,690 |

| Florida | $45,530 |

| Georgia | $51,720 |

| Hawaii | $47,810 |

| Idaho | $42,490 |

| Illinois | $47,290 |

| Indiana | $45,030 |

| Iowa | $43,690 |

| Kansas | $47,910 |

| Kentucky | $44,590 |

| Louisiana | $36,840 |

| Maine | $40,880 |

| Maryland | $47,330 |

| Massachusetts | $57,600 |

| Michigan | $48,340 |

| Minnesota | $51,190 |

| Mississippi | $42,660 |

| Missouri | $53,250 |

| Montana | $44,540 |

| Nevada | $56,510 |

| New Hampshire | $45,850 |

| New Jersey | $68,360 |

| New Mexico | $37,870 |

| New York | $60,520 |

| North Carolina | $54,400 |

| North Dakota | $43,330 |

| Ohio | $51,200 |

| Oklahoma | $42,290 |

| Oregon | $48,090 |

| Pennsylvania | $55,770 |

| Rhode Island | $59,760 |

| South Carolina | $45,320 |

| South Dakota | $38,900 |

| Tennessee | $48,560 |

| Texas | $46,160 |

| Utah | $38,070 |

| Virginia | $50,860 |

| Washington | $48,230 |

| West Virginia | $38,910 |

| Wisconsin | $39,860 |

| Wyoming | $50,960 |

Tools & Technologies Used by Credit Counselors

Although they’re not necessarily needed for all jobs, the following technologies are used by many Credit Counselors:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- Email software

- SAP

- Microsoft Dynamics

- Oracle PeopleSoft

- LexisNexis

- Freddie Mac Loan Prospector

- Chat software

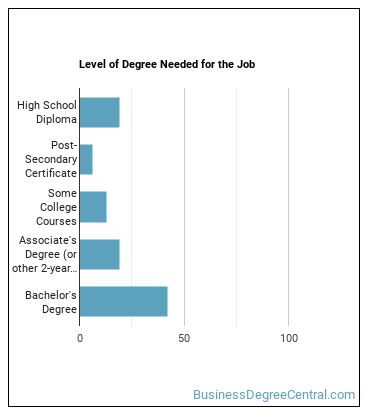

How to Become a Credit Counselor

Individuals working as a Credit Counselor have obtained the following education levels:

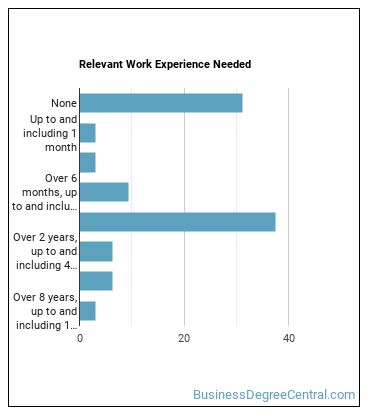

How many years of work experience do I need?

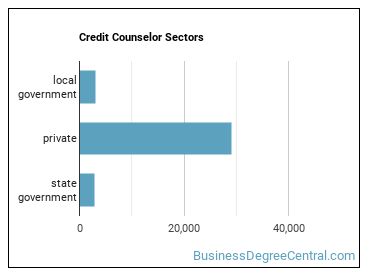

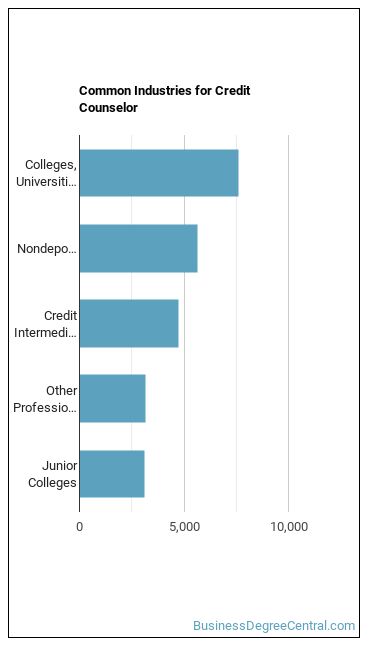

Where do Credit Counselors Work?

The table below shows some of the most common industries where those employed in this career field work.

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School