What is a Loan Interviewer or Clerk?

Loan Interviewer or Clerk Example Interview loan applicants to elicit information; investigate applicants’ backgrounds and verify references; prepare loan request papers; and forward findings, reports, and documents to appraisal department. Review loan papers to ensure completeness, and complete transactions between loan establishment, borrowers, and sellers upon approval of loan.

What Do Loan Interviewers and Clerks Do On a Daily Basis?

- Record applications for loan and credit, loan information, and disbursements of funds, using computers.

- Order property insurance or mortgage insurance policies to ensure protection against loss on mortgaged property.

- Review customer accounts to determine whether payments are made on time and that other loan terms are being followed.

- Contact credit bureaus, employers, and other sources to check applicants’ credit and personal references.

- Calculate, review, and correct errors on interest, principal, payment, and closing costs, using computers or calculators.

- Accept payment on accounts.

Featured schools near , edit

Loan Interviewer or Clerk Required Skills

Loan Interviewers and Clerks state the following job skills are important in their day-to-day work.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Complex Problem Solving: Identifying complex problems and reviewing related information to develop and evaluate options and implement solutions.

Related Job Titles for this Occupation:

- Underwriter

- Closing Agent

- Closer

- Document Coordinator

- Loan Expeditor

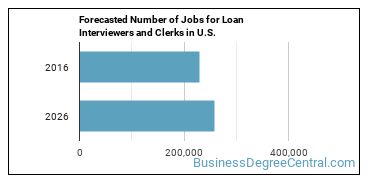

Job Demand for Loan Interviewers and Clerks

There were about 229,800 jobs for Loan Interviewer or Clerk in 2016 (in the United States). New jobs are being produced at a rate of 12.4% which is above the national average. The Bureau of Labor Statistics predicts 28,400 new jobs for Loan Interviewer or Clerk by 2026. There will be an estimated 25,700 positions for Loan Interviewer or Clerk per year.

The states with the most job growth for Loan Interviewer or Clerk are Utah, Arizona, and Iowa. Watch out if you plan on working in Alaska, West Virginia, or Vermont. These states have the worst job growth for this type of profession.

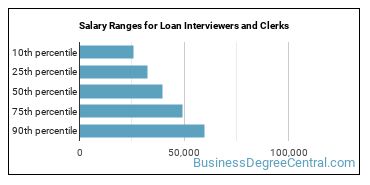

How Much Does a Loan Interviewer or Clerk Make?

The salary for Loan Interviewers and Clerks ranges between about $25,600 and $59,710 a year.

Loan Interviewers and Clerks who work in District of Columbia, Connecticut, or Colorado, make the highest salaries.

How much do Loan Interviewers and Clerks make in different U.S. states?

| State | Annual Mean Salary |

|---|---|

| Alabama | $33,910 |

| Alaska | $42,190 |

| Arizona | $40,530 |

| Arkansas | $39,000 |

| California | $46,480 |

| Colorado | $47,630 |

| Connecticut | $48,160 |

| Delaware | $38,830 |

| District of Columbia | $55,320 |

| Florida | $41,590 |

| Georgia | $37,910 |

| Hawaii | $47,970 |

| Idaho | $37,450 |

| Illinois | $42,440 |

| Indiana | $36,370 |

| Iowa | $37,930 |

| Kansas | $39,880 |

| Kentucky | $36,350 |

| Louisiana | $32,660 |

| Maine | $36,620 |

| Maryland | $45,030 |

| Massachusetts | $43,030 |

| Michigan | $39,490 |

| Minnesota | $42,250 |

| Mississippi | $32,290 |

| Missouri | $38,350 |

| Montana | $36,630 |

| Nebraska | $41,610 |

| Nevada | $39,240 |

| New Hampshire | $40,060 |

| New Jersey | $45,770 |

| New Mexico | $34,430 |

| New York | $45,520 |

| North Carolina | $42,540 |

| North Dakota | $42,990 |

| Ohio | $38,510 |

| Oklahoma | $34,100 |

| Oregon | $46,040 |

| Pennsylvania | $34,790 |

| Rhode Island | $41,460 |

| South Carolina | $38,560 |

| South Dakota | $34,820 |

| Tennessee | $39,060 |

| Texas | $44,190 |

| Utah | $39,710 |

| Vermont | $40,190 |

| Virginia | $42,990 |

| Washington | $44,570 |

| West Virginia | $32,200 |

| Wisconsin | $40,110 |

| Wyoming | $39,120 |

What Tools & Technology do Loan Interviewers and Clerks Use?

Below is a list of the types of tools and technologies that Loan Interviewers and Clerks may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Dynamics

- Desktop publishing software

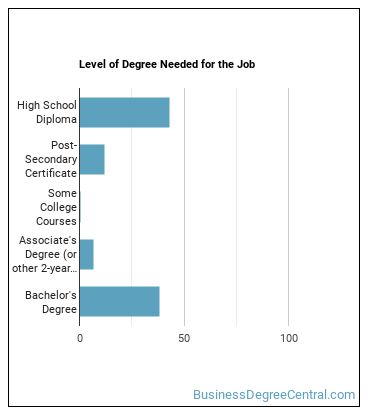

Becoming a Loan Interviewer or Clerk

Learn what Loan Interviewer or Clerk education requirements there are.

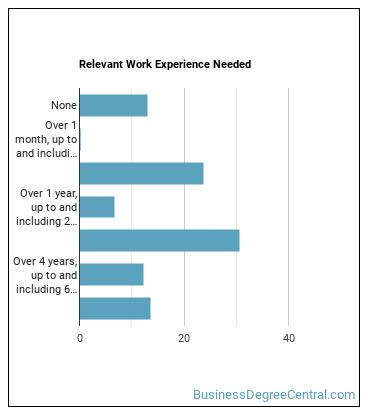

What work experience do I need to become a Loan Interviewer or Clerk?

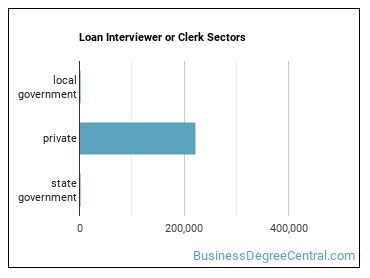

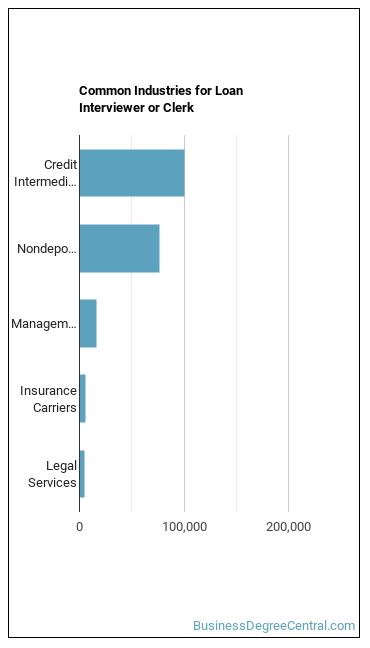

Who Employs Loan Interviewers and Clerks?

Loan Interviewers and Clerks work in the following industries:

You May Also Be Interested In…

Those interested in being a Loan Interviewer or Clerk may also be interested in:

Are you already one of the many Loan Interviewer or Clerk in the United States? If you’re thinking about changing careers, these fields are worth exploring:

- Eligibility Interviewers, Government Programs

- Credit Analysts

- Claims Examiners, Property and Casualty Insurance

- Procurement Clerks

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School