What You Need to Know About Property and Casualty Insurance Claims Examiner

Insurance Claims Examiner Definition Review settled insurance claims to determine that payments and settlements have been made in accordance with company practices and procedures. Report overpayments, underpayments, and other irregularities. Confer with legal counsel on claims requiring litigation.

A Day in the Life of an Insurance Claims Examiner

- Present cases and participate in their discussion at claim committee meetings.

- Report overpayments, underpayments, and other irregularities.

- Contact or interview claimants, doctors, medical specialists, or employers to get additional information.

- Investigate, evaluate, and settle claims, applying technical knowledge and human relations skills to effect fair and prompt disposal of cases and to contribute to a reduced loss ratio.

- Examine claims investigated by insurance adjusters, further investigating questionable claims to determine whether to authorize payments.

- Maintain claim files, such as records of settled claims and an inventory of claims requiring detailed analysis.

Featured schools near , edit

Insurance Claims Examiner Required Skills

Below is a list of the skills most Property and Casualty Insurance Claims Examiners say are important on the job.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Negotiation: Bringing others together and trying to reconcile differences.

Types of Property and Casualty Insurance Claims Examiner

- Claim Auditor

- Liability Claims Manager

- Claims Analyst

- Claims Examiner

- Claims Director

Job Outlook for Property and Casualty Insurance Claims Examiners

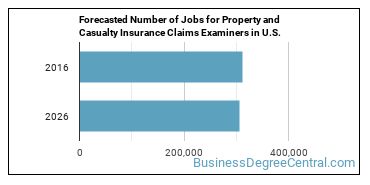

There were about 311,100 jobs for Property and Casualty Insurance Claims Examiner in 2016 (in the United States). There is little to no growth in job opportunities for Property and Casualty Insurance Claims Examiner. The BLS estimates 24,500 yearly job openings in this field.

The states with the most job growth for Insurance Claims Examiner are Utah, Arizona, and Colorado. Watch out if you plan on working in Maine, District of Columbia, or Mississippi. These states have the worst job growth for this type of profession.

How Much Does an Insurance Claims Examiner Make?

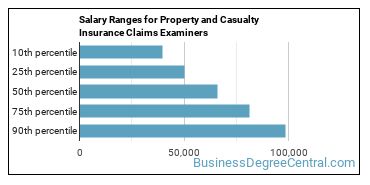

Property and Casualty Insurance Claims Examiners make between $39,620 and $98,660 a year.

Property and Casualty Insurance Claims Examiners who work in Connecticut, Massachusetts, or New Jersey, make the highest salaries.

How much do Property and Casualty Insurance Claims Examiners make in each U.S. state?

| State | Annual Mean Salary |

|---|---|

| Alabama | $65,060 |

| Alaska | $73,370 |

| Arizona | $67,340 |

| Arkansas | $61,930 |

| California | $71,720 |

| Colorado | $72,460 |

| Connecticut | $78,590 |

| Delaware | $63,440 |

| District of Columbia | $74,210 |

| Florida | $62,840 |

| Georgia | $65,430 |

| Hawaii | $62,860 |

| Idaho | $63,020 |

| Illinois | $65,980 |

| Indiana | $63,480 |

| Iowa | $62,750 |

| Kansas | $67,570 |

| Kentucky | $55,820 |

| Louisiana | $66,440 |

| Maine | $60,980 |

| Maryland | $72,050 |

| Massachusetts | $76,150 |

| Michigan | $67,860 |

| Minnesota | $65,760 |

| Mississippi | $62,700 |

| Missouri | $66,340 |

| Montana | $55,970 |

| Nebraska | $61,050 |

| Nevada | $65,510 |

| New Hampshire | $71,190 |

| New Jersey | $74,260 |

| New Mexico | $63,890 |

| New York | $71,950 |

| North Carolina | $62,580 |

| North Dakota | $58,580 |

| Ohio | $65,890 |

| Oklahoma | $61,670 |

| Oregon | $67,750 |

| Pennsylvania | $67,730 |

| Rhode Island | $71,950 |

| South Carolina | $62,950 |

| South Dakota | $61,490 |

| Tennessee | $60,550 |

| Texas | $69,560 |

| Utah | $59,330 |

| Vermont | $66,240 |

| Virginia | $63,640 |

| Washington | $72,340 |

| West Virginia | $57,030 |

| Wisconsin | $63,420 |

| Wyoming | $65,300 |

Tools & Technologies Used by Property and Casualty Insurance Claims Examiners

Although they’re not necessarily needed for all jobs, the following technologies are used by many Property and Casualty Insurance Claims Examiners:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Publisher

- Medical procedure coding software

- Healthcare common procedure coding system HCPCS

- Medical condition coding software

- Document management system software

- Hyland OnBase Enterprise Content Management

- Axonwave Fraud and Abuse Management System

- StrataCare StrataWare eReview

- LexisNexis RiskWise

- CCC Pathways Appraisal Quality Solution

- ISO NetMap for Claims

- ISO ClaimSearch

- IBM Fraud and Abuse Management System

- Hummingbird Legal Bill Review

- Agency Management Systems AMS 360

- AutoClaims Direct DirectLink

Becoming an Insurance Claims Examiner

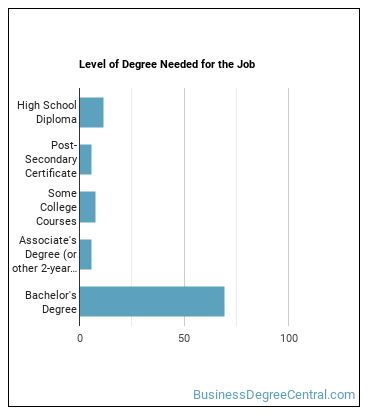

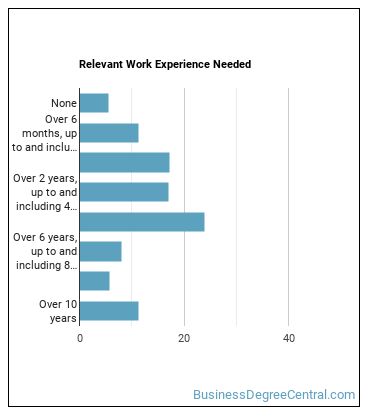

Are there Property and Casualty Insurance Claims Examiners education requirements?

How Long Does it Take to Become an Insurance Claims Examiner?

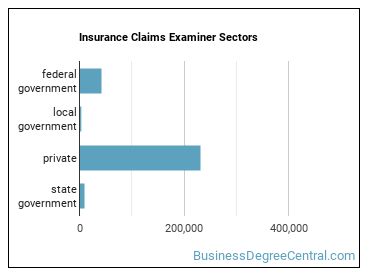

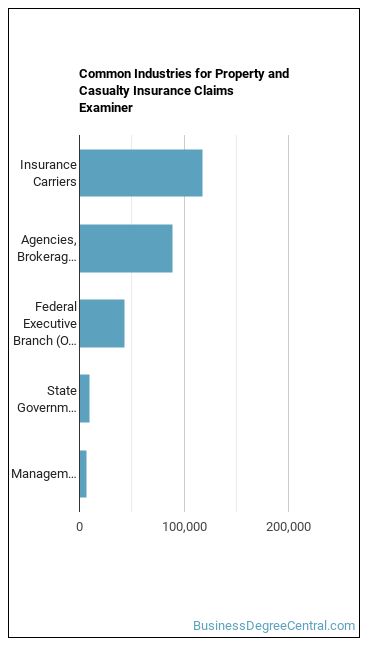

Where Property and Casualty Insurance Claims Examiners Work

Property and Casualty Insurance Claims Examiners work in the following industries:

You May Also Be Interested In…

Those interested in being a Property and Casualty Insurance Claims Examiner may also be interested in:

- Social Science Research Assistants

- Loan Counselors

- Cost Estimators

- Title Examiners, Abstractors, and Searchers

- Financial Analysts

Are you already one of the many Property and Casualty Insurance Claims Examiner in the United States? If you’re thinking about changing careers, these fields are worth exploring:

References:

Image Credit: Nick Youngson via Creative Commons 3 - CC BY-SA 3.0

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School