All About Insurance Underwriters

Position Description Review individual applications for insurance to evaluate degree of risk involved and determine acceptance of applications.

Life As an Insurance Underwriter: What Do They Do?

- Write to field representatives, medical personnel, or others to obtain further information, quote rates, or explain company underwriting policies.

- Evaluate possibility of losses due to catastrophe or excessive insurance.

- Examine documents to determine degree of risk from factors such as applicant health, financial standing and value, and condition of property.

- Review company records to determine amount of insurance in force on single risk or group of closely related risks.

- Decline excessive risks.

- Authorize reinsurance of policy when risk is high.

Featured schools near , edit

What Skills Do You Need to Work as an Insurance Underwriter?

Insurance Underwriters state the following job skills are important in their day-to-day work.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Speaking: Talking to others to convey information effectively.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Types of Insurance Underwriter Jobs

- Personal Lines Underwriter

- Underwriter

- Underwriting Consultant

- Marine Underwriter

- Life Underwriter

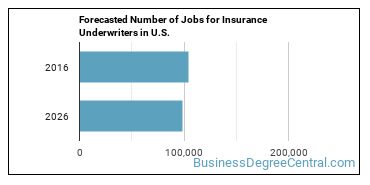

Job Outlook for Insurance Underwriters

In the United States, there were 104,100 jobs for Insurance Underwriter in 2016. There is little to no growth in job opportunities for Insurance Underwriter. Due to new job openings and attrition, there will be an average of 7,500 job openings in this field each year.

The states with the most job growth for Insurance Underwriter are Utah, Arizona, and Maryland. Watch out if you plan on working in Vermont, Maine, or Wyoming. These states have the worst job growth for this type of profession.

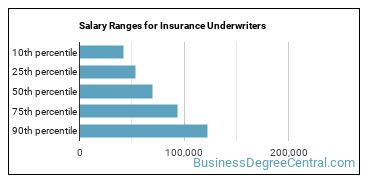

Salary for an Insurance Underwriter

Insurance Underwriters make between $42,260 and $122,840 a year.

Insurance Underwriters who work in New Hampshire, District of Columbia, or New Jersey, make the highest salaries.

Below is a list of the median annual salaries for Insurance Underwriters in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $60,750 |

| Alaska | $67,430 |

| Arizona | $73,290 |

| Arkansas | $55,290 |

| California | $88,140 |

| Colorado | $77,170 |

| Connecticut | $85,010 |

| Delaware | $67,330 |

| District of Columbia | $87,010 |

| Florida | $70,900 |

| Georgia | $81,290 |

| Hawaii | $67,040 |

| Idaho | $68,710 |

| Illinois | $75,690 |

| Indiana | $77,190 |

| Iowa | $71,680 |

| Kansas | $74,630 |

| Kentucky | $69,940 |

| Louisiana | $69,440 |

| Maine | $68,390 |

| Maryland | $77,650 |

| Massachusetts | $82,540 |

| Michigan | $70,270 |

| Minnesota | $68,410 |

| Mississippi | $65,530 |

| Missouri | $68,250 |

| Montana | $76,830 |

| Nebraska | $68,120 |

| Nevada | $67,260 |

| New Hampshire | $81,280 |

| New Jersey | $88,510 |

| New Mexico | $61,050 |

| New York | $92,810 |

| North Carolina | $78,220 |

| North Dakota | $68,310 |

| Ohio | $74,370 |

| Oklahoma | $59,820 |

| Oregon | $72,570 |

| Pennsylvania | $77,300 |

| Rhode Island | $71,260 |

| South Carolina | $55,320 |

| South Dakota | $78,370 |

| Tennessee | $68,630 |

| Texas | $68,390 |

| Utah | $60,040 |

| Vermont | $65,610 |

| Virginia | $68,950 |

| Washington | $81,210 |

| West Virginia | $58,830 |

| Wisconsin | $68,670 |

What Tools do Insurance Underwriters Use?

Below is a list of the types of tools and technologies that Insurance Underwriters may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Web browser software

- Word processing software

- Spreadsheet software

- Database software

- LexisNexis

- Delphi Technology

- C++

- Fannie Mae Desktop Underwriter

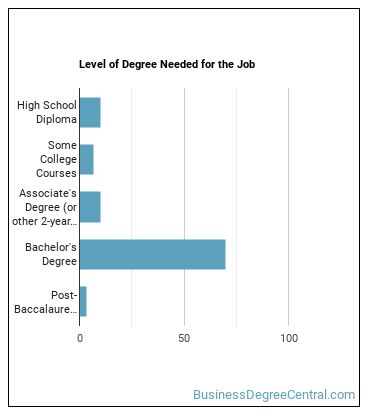

Becoming an Insurance Underwriter

Individuals working as an Insurance Underwriter have obtained the following education levels:

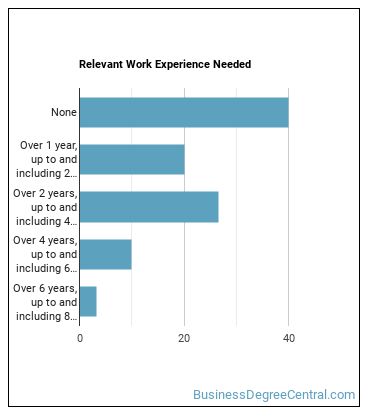

What work experience do I need to become an Insurance Underwriter?

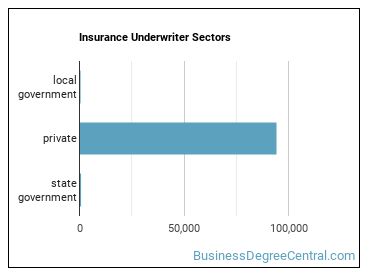

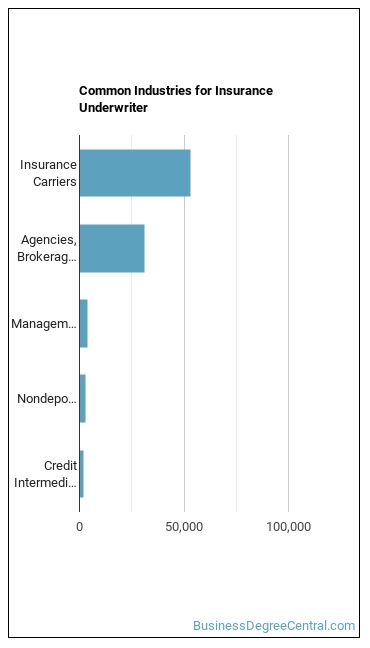

Where do Insurance Underwriters Work?

Insurance Underwriters work in the following industries:

References:

Image Credit: Nick Youngson via Creative Commons 3 - CC BY-SA 3.0

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School