What Do Loan Officer Do?

Occupation Description Evaluate, authorize, or recommend approval of commercial, real estate, or credit loans. Advise borrowers on financial status and payment methods. Includes mortgage loan officers and agents, collection analysts, loan servicing officers, and loan underwriters.

A Day in the Life of a Loan Officer

- Market bank products to individuals and firms, promoting bank services that may meet customers’ needs.

- Prepare reports to send to customers whose accounts are delinquent, and forward irreconcilable accounts for collector action.

- Obtain and compile copies of loan applicants’ credit histories, corporate financial statements, and other financial information.

- Submit applications to credit analysts for verification and recommendation.

- Provide special services such as investment banking for clients with more specialized needs.

- Stay abreast of new types of loans and other financial services and products to better meet customers’ needs.

Featured schools near , edit

What a Loan Officer Should Know

When polled, Loan Officers say the following skills are most frequently used in their jobs:

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Service Orientation: Actively looking for ways to help people.

Types of Loan Officer Jobs

- Mortgage Consultant

- Loan Originator

- Banking Services Officer

- Loan Workout Officer

- Relationship Manager

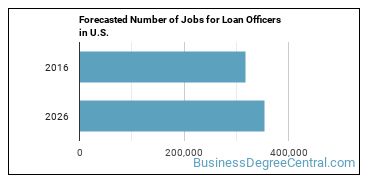

Loan Officer Employment Estimates

There were about 318,600 jobs for Loan Officer in 2016 (in the United States). New jobs are being produced at a rate of 11.4% which is above the national average. The Bureau of Labor Statistics predicts 36,300 new jobs for Loan Officer by 2026. Due to new job openings and attrition, there will be an average of 30,400 job openings in this field each year.

The states with the most job growth for Loan Officer are Utah, Arizona, and Iowa. Watch out if you plan on working in Alaska, West Virginia, or Maryland. These states have the worst job growth for this type of profession.

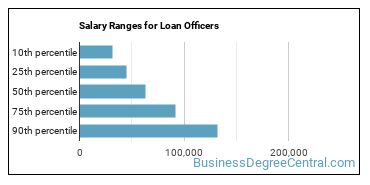

Do Loan Officers Make A Lot Of Money?

The typical yearly salary for Loan Officers is somewhere between $31,870 and $132,080.

Loan Officers who work in New York, New Hampshire, or Nebraska, make the highest salaries.

How much do Loan Officers make in each U.S. state?

| State | Annual Mean Salary |

|---|---|

| Alabama | $67,860 |

| Alaska | $71,120 |

| Arizona | $62,430 |

| Arkansas | $73,990 |

| California | $78,940 |

| Colorado | $71,010 |

| Connecticut | $91,730 |

| Delaware | $70,100 |

| District of Columbia | $95,000 |

| Florida | $78,000 |

| Georgia | $75,060 |

| Hawaii | $72,790 |

| Idaho | $60,810 |

| Illinois | $81,620 |

| Indiana | $67,450 |

| Iowa | $67,580 |

| Kansas | $84,320 |

| Kentucky | $67,450 |

| Louisiana | $56,190 |

| Maine | $76,340 |

| Maryland | $84,240 |

| Massachusetts | $94,540 |

| Minnesota | $79,420 |

| Mississippi | $65,360 |

| Missouri | $76,550 |

| Montana | $63,910 |

| Nebraska | $81,740 |

| Nevada | $80,290 |

| New Hampshire | $90,500 |

| New Jersey | $85,540 |

| New Mexico | $63,320 |

| New York | $103,450 |

| North Carolina | $72,210 |

| North Dakota | $74,330 |

| Ohio | $72,030 |

| Oklahoma | $67,810 |

| Oregon | $76,680 |

| Pennsylvania | $68,280 |

| Rhode Island | $69,500 |

| South Carolina | $69,240 |

| South Dakota | $63,230 |

| Tennessee | $63,810 |

| Texas | $83,910 |

| Utah | $57,640 |

| Vermont | $66,350 |

| Virginia | $80,440 |

| Washington | $74,830 |

| West Virginia | $55,370 |

| Wisconsin | $73,390 |

| Wyoming | $69,530 |

What Tools do Loan Officers Use?

Below is a list of the types of tools and technologies that Loan Officers may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Data entry software

- Microsoft Dynamics

- IBM Notes

- LexisNexis

- Tax software

- Customer information control system CICS

- Common business oriented language COBOL

- Delphi Discovery

- CGI-AMS BureauLink Enterprise

- Experian Credinomics

- Moody’s KMV CreditEdge

- Harland Financial Solutions DecisionPro

- Fair Isaac Falcon ID

- Fannie Mae Desktop Underwriter

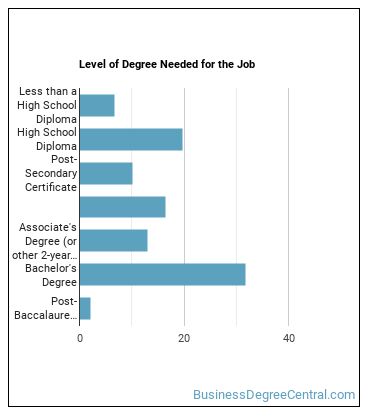

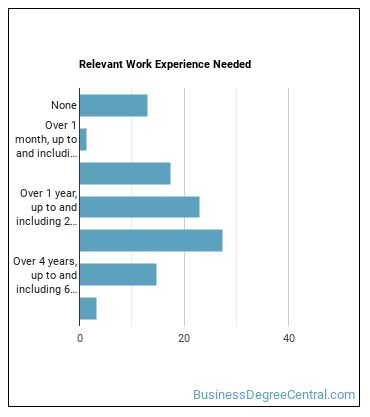

Becoming a Loan Officer

What education or degrees do I need to become a Loan Officer?

How Long Does it Take to Become a Loan Officer?

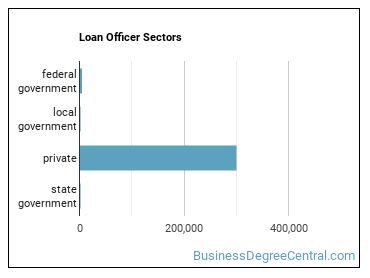

Who Employs Loan Officers?

Loan Officers work in the following industries:

Similar Careers

Those interested in being a Loan Officer may also be interested in:

Career changers with experience as a Loan Officer sometimes find work in one of the following fields:

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School