Financial Planning & Services Schools in Michigan

39 Financial Planning students earned their degrees in the state in 2020-2021.

In terms of popularity, Financial Planning & Services is the 52nd most popular major in the state out of a total 97 majors commonly available.

Featured schools near , edit

Education Levels of Financial Planning & Services Majors in Michigan

Financial Planning majors in the state tend to have the following degree levels:

| Education Level | Number of Grads |

|---|---|

| Bachelor’s Degree | 33 |

| Award Taking Less Than 1 Year | 3 |

| Award Taking 12 Weeks to 1 Year | 3 |

| Master’s Degree | 3 |

| Award Taking Less 12 Weeks | 3 |

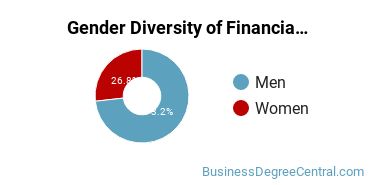

Gender Distribution

In Michigan, a financial planning major is more popular with men than with women.

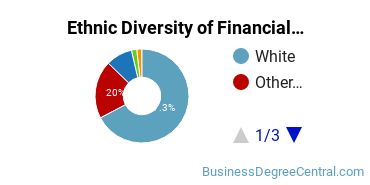

Racial Distribution

The racial distribution of financial planning majors in Michigan is as follows:

- Asian: 0.0%

- Black or African American: 2.6%

- Hispanic or Latino: 2.6%

- White: 92.3%

- Non-Resident Alien: 0.0%

- Other Races: 2.6%

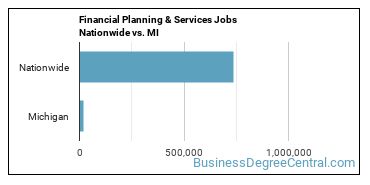

Jobs for Financial Planning & Services Grads in Michigan

17,150 people in the state and 736,120 in the nation are employed in jobs related to financial planning.

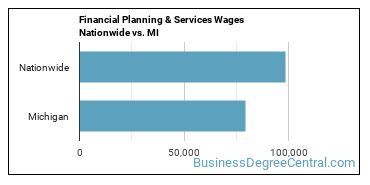

Wages for Financial Planning & Services Jobs in Michigan

In this state, financial planning grads earn an average of $79,320. Nationwide, they make an average of $98,770.

Most Popular Financial Planning & Services Programs in MI

There are 6 colleges in Michigan that offer financial planning degrees. Learn about the most popular 6 below:

The full-time teacher rate is 76%. The student loan default rate of 4.80% is a good sign that graduates can afford their loan payments. The student to faculty ratio is 18 to 1.

A typical student attending WMU will pay a net price of $20,371. In their early career, WMU grads earn an average salary of $40,533. The 5.60% student loan default rate is lower than average.

Roughly six years after entering college, graduates of this school earn $43,573 a year. The student to faculty ratio is 12 to 1. Most students complete their degree in 4.19 years.

This private institution charges an average net price of $20,053. 100% of the teachers are full time. 15 to 1 is the student to faculty ratio.

Students who attend this private institution pay an average net price of $12,575. The student loan default rate of 8.60% is a good sign that graduates can afford their loan payments. The average student takes 4.70 years to complete their degree at Baker College.

Seeking financial aid? At this school, 100% of students receive it. Of all the teachers who work at the school, 9% are considered full time. In their early career, Cleary College grads earn an average salary of $48,709.

Financial Planning & Services Careers in MI

Some of the careers financial planning majors go into include:

| Job Title | MI Job Growth | MI Median Salary |

|---|---|---|

| Credit Counselors | 23% | $47,370 |

| Personal Financial Advisors | 15% | $73,050 |

| Securities, Commodities, and Financial Services Sales Agents | 6% | $51,070 |

Related Majors in Michigan

Below are some popular majors in the state that are similar to financial planning.

| Major | Annual Graduates in MI |

|---|---|

| Finance | 1,634 |

| Other Financial Management | 18 |

View all majors related to Financial Planning & Services

Explore Major by State

Alabama

Arkansas

Connecticut

Florida

Idaho

Iowa

Louisiana

Massachusetts

Mississippi

Nebraska

New Jersey

North Carolina

Oklahoma

Rhode Island

Tennessee

Vermont

West Virginia

View Nationwide Financial Planning & Services Report

References

- College Factual

- National Center for Education Statistics

- O*NET Online

- Image Credit: By Dave Dugdale under License

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School