What is a Tax Preparer?

Career Description Prepare tax returns for individuals or small businesses.

List of Tax Preparer Job Duties

- Consult tax law handbooks or bulletins to determine procedures for preparation of atypical returns.

- Calculate form preparation fees according to return complexity and processing time required.

- Furnish taxpayers with sufficient information and advice to ensure correct tax form completion.

- Review financial records such as income statements and documentation of expenditures to determine forms needed to prepare tax returns.

- Explain federal and state tax laws to individuals and companies.

- Interview clients to obtain additional information on taxable income and deductible expenses and allowances.

Featured schools near , edit

What a Tax Preparer Should Know

Below is a list of the skills most Tax Preparers say are important on the job.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Speaking: Talking to others to convey information effectively.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Mathematics: Using mathematics to solve problems.

Other Tax Preparer Job Titles

- Licensed Tax Consultant

- Tax Evaluator

- Tax Associate

- Tax Manager

- Income Tax Preparer

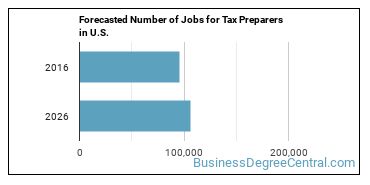

Tax Preparer Employment Estimates

In 2016, there was an estimated number of 95,900 jobs in the United States for Tax Preparer. New jobs are being produced at a rate of 10.7% which is above the national average. The Bureau of Labor Statistics predicts 10,300 new jobs for Tax Preparer by 2026. Due to new job openings and attrition, there will be an average of 11,500 job openings in this field each year.

The states with the most job growth for Tax Preparer are Tennessee, Utah, and Nevada. Watch out if you plan on working in Maine, Missouri, or Wyoming. These states have the worst job growth for this type of profession.

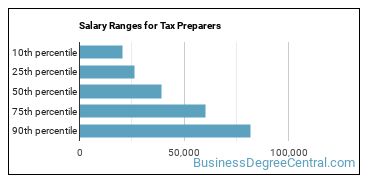

What is the Average Salary of a Tax Preparer

The typical yearly salary for Tax Preparers is somewhere between $20,550 and $81,720.

Tax Preparers who work in New York, Massachusetts, or Colorado, make the highest salaries.

Below is a list of the median annual salaries for Tax Preparers in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $38,520 |

| Alaska | $55,760 |

| Arizona | $39,270 |

| Arkansas | $36,240 |

| California | $57,040 |

| Colorado | $57,650 |

| Connecticut | $50,810 |

| District of Columbia | $97,070 |

| Florida | $39,020 |

| Georgia | $39,950 |

| Hawaii | $55,990 |

| Idaho | $33,220 |

| Illinois | $30,200 |

| Indiana | $40,780 |

| Iowa | $42,930 |

| Kansas | $37,320 |

| Kentucky | $37,920 |

| Louisiana | $39,590 |

| Maine | $38,270 |

| Maryland | $52,530 |

| Massachusetts | $65,670 |

| Minnesota | $50,440 |

| Mississippi | $28,770 |

| Missouri | $40,480 |

| Montana | $40,170 |

| Nebraska | $37,530 |

| Nevada | $49,030 |

| New Hampshire | $49,090 |

| New Jersey | $51,840 |

| New Mexico | $42,040 |

| New York | $63,440 |

| North Carolina | $45,460 |

| North Dakota | $53,920 |

| Ohio | $47,010 |

| Oklahoma | $42,820 |

| Oregon | $56,960 |

| Pennsylvania | $38,910 |

| Rhode Island | $41,770 |

| South Carolina | $41,000 |

| South Dakota | $42,650 |

| Tennessee | $46,670 |

| Texas | $49,750 |

| Utah | $46,470 |

| Vermont | $46,830 |

| Virginia | $34,090 |

| Washington | $38,130 |

| West Virginia | $30,910 |

| Wisconsin | $45,840 |

| Wyoming | $29,160 |

Tools & Technologies Used by Tax Preparers

Below is a list of the types of tools and technologies that Tax Preparers may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft Outlook

- Microsoft Access

- Email software

- Intuit QuickBooks

- Microsoft Internet Explorer

- Sage 50 Accounting

- Tax software

- Intuit Quicken

- ATX Total Accounting Office

- Web page creation and editing software

- Laserfiche Avante

- Universal Tax Systems TaxWise

- Intuit ProSeries

- CCH ProSystem fx TAX

- ATX Total Tax Office

- Sync Essentials Trade Accountant

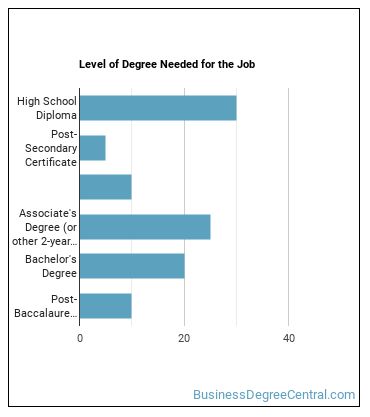

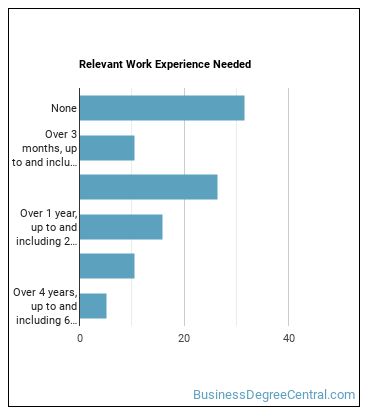

Becoming a Tax Preparer

What education is needed to be a Tax Preparer?

How Long Does it Take to Become a Tax Preparer?

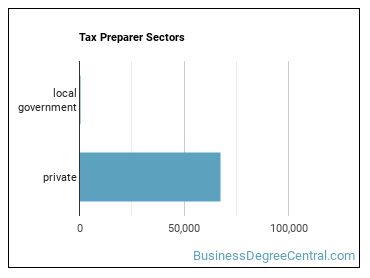

Where Tax Preparers Are Employed

Below are examples of industries where Tax Preparers work:

Other Jobs You May be Interested In

Those thinking about becoming a Tax Preparer might also be interested in the following careers:

Career changers with experience as a Tax Preparer sometimes find work in one of the following fields:

References:

Image Credit: Pixabay via CC0 License

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School