Featured schools near , edit

Types of Degrees Majors Are Getting

The following table lists how many tax law/taxation graduations there were for each degree level during the last year for which data was available.

| Education Level | Number of Grads |

|---|---|

| Master’s Degree | 872 |

| Graduate Certificate | 87 |

| Doctor’s Degree | 3 |

What Majors Need to Know

In an O*NET survey, tax law/taxation majors were asked to rate what knowledge areas, skills, and abilities were important in their occupations. These answers were weighted on a scale of 1 to 5 with 5 being the most important.

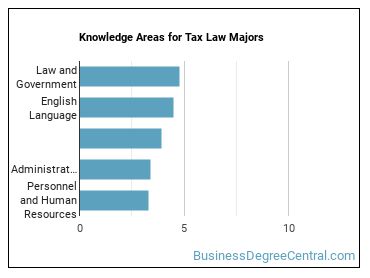

Knowledge Areas for Tax Law/Taxation Majors

Tax Law/Taxation majors often go into careers in which the following knowledge areas are important:

- Law and Government - Knowledge of laws, legal codes, court procedures, precedents, government regulations, executive orders, agency rules, and the democratic political process.

- English Language - Knowledge of the structure and content of the English language including the meaning and spelling of words, rules of composition, and grammar.

- Customer and Personal Service - Knowledge of principles and processes for providing customer and personal services. This includes customer needs assessment, meeting quality standards for services, and evaluation of customer satisfaction.

- Administration and Management - Knowledge of business and management principles involved in strategic planning, resource allocation, human resources modeling, leadership technique, production methods, and coordination of people and resources.

- Personnel and Human Resources - Knowledge of principles and procedures for personnel recruitment, selection, training, compensation and benefits, labor relations and negotiation, and personnel information systems.

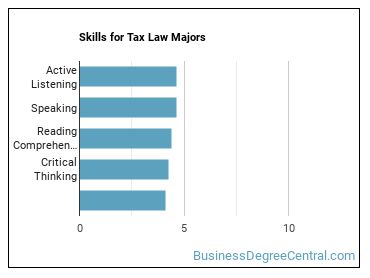

Skills for Tax Law/Taxation Majors

The following list of skills has been highlighted as some of the most essential for careers related to tax law/taxation:

- Active Listening - Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

- Speaking - Talking to others to convey information effectively.

- Reading Comprehension - Understanding written sentences and paragraphs in work related documents.

- Critical Thinking - Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

- Complex Problem Solving - Identifying complex problems and reviewing related information to develop and evaluate options and implement solutions.

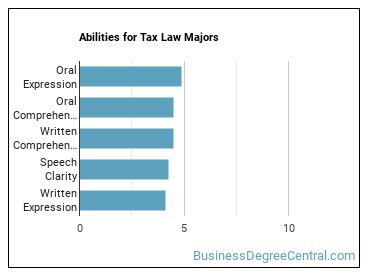

Abilities for Tax Law/Taxation Majors

A major in tax law/taxation will prepare for your careers in which the following abilities are important:

- Oral Expression - The ability to communicate information and ideas in speaking so others will understand.

- Oral Comprehension - The ability to listen to and understand information and ideas presented through spoken words and sentences.

- Written Comprehension - The ability to read and understand information and ideas presented in writing.

- Speech Clarity - The ability to speak clearly so others can understand you.

- Written Expression - The ability to communicate information and ideas in writing so others will understand.

How Much Do Majors Make?

Salaries According to BLS

The median salary for someone in a career related to tax law/taxation is $144,230. This median refers to all degree levels, so the salary for a person with just a bachelor’s degree may be a little less and the one for a person with an advanced degree may be a little more.

To put that into context, according to BLS data from the first quarter of 2020, the typical high school graduate makes between $30,000 and $57,900 a year (25th through 75th percentile). The average person with a bachelor’s degree (any field) makes between $45,600 and $99,000. Advanced degree holders make the most with salaries between $55,600 and $125,400.

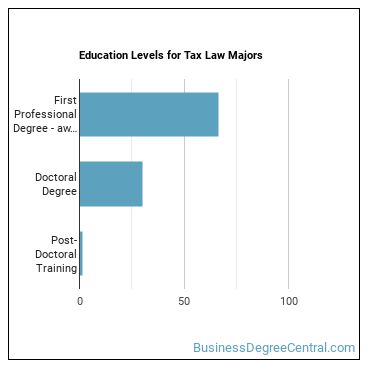

Amount of Education Required for Careers Related to

Some degrees associated with tax law/taxation may require an advanced degree, while others may not even require a bachelor’s in the field. In general, the more advanced your degree the more career options will open up to you. However, there is significant time and money that needs to be invested into your education so weigh the pros and cons.

How much schooling do you really need to compete in today’s job market? People currently working in careers related to tax law/taxation have obtained the following education levels.

| Education Level | Percentage of Workers |

|---|---|

| First Professional Degree - awarded for completion of a program that: requires at least 2 years of college work before entrance into the program, includes a total of at least 6 academic years of work to complete, and provides all remaining academic requirements to begin practice in a profession. | 66.6% |

| Doctoral Degree | 30.3% |

| Post-Doctoral Training | 1.3% |

Online Programs

The following table lists the number of programs by degree level, along with how many schools offered online courses in the field.

| Degree Level | Colleges Offering Programs | Colleges Offering Online Classes |

|---|---|---|

| Certificate (Less Than 1 Year) | 0 | 0 |

| Certificate (1-2 years) | 1 | 0 |

| Certificate (2-4 Years) | 0 | 0 |

| Associate’s Degree | 0 | 0 |

| Bachelor’s Degree | 4 | 0 |

| Post-Baccalaureate | 0 | 0 |

| Master’s Degree | 31 | 6 |

| Post-Master’s | 4 | 0 |

| Doctor’s Degree (Research) | 1 | 0 |

| Doctor’s Degree (Professional Practice) | 0 | 0 |

| Doctor’s Degree (Other) | 0 | 0 |

Is a Degree in Worth It?

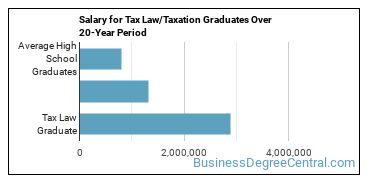

The median salary for a tax law/taxation grad is $144,230 per year. This is based on the weighted average of the most common careers associated with the major.

This is 261% more than the average salary for an individual holding a high school degree. This adds up to a gain of about $2,086,600 after 20 years!

Explore Major by State

Alabama

California

District of Columbia

Idaho

Kansas

Maryland

Mississippi

Nevada

New York

Oklahoma

South Carolina

Utah

West Virginia

Alaska

Colorado

Florida

Illinois

Kentucky

Massachusetts

Missouri

New Hampshire

North Carolina

Oregon

South Dakota

Vermont

Wisconsin

Majors Related to

You may also be interested in one of the following majors related to tax law/taxation.

| Major | Number of Grads |

|---|---|

| Banking, Corporate, Finance, & Securities Law | 487 |

| International Business, Trade, & Tax Law | 379 |

References

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

- College Factual

- College Scorecard

- National Center for Education Statistics

- O*NET Online

- U.S. Bureau of Labor Statistics

- Usual Weekly Earnings of Wage and Salary Workers First Quarter 2020

More about our data sources and methodologies.

Featured Schools

You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs.

Visit School